When most people think about investing, they automatically picture the stock market. However, there is another type of investment that can be just as fascinating and profitable: vintage stock certificates. These pieces of paper represent a bygone era when businesses were smaller and less regulated and when the stock market wasn’t quite so overwhelming.

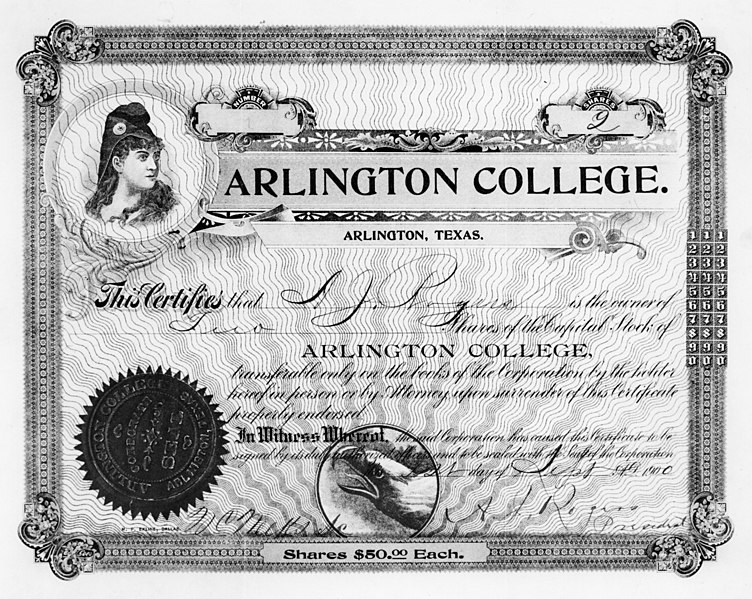

So what exactly are authentic vintage stock certificates? Essentially, they are certificates that investors would receive to prove their ownership stake in a company. Before electronic trading became the norm, these certificates were physical pieces of paper that came in all shapes, sizes, and designs. In case you’re interested in vintage stock certificates, this blog is for you.

In this blog, we will discuss the importance of investing in vintage stock certificates.

Why Invest in Vintage Stock Certificates?

There are several reasons why you might consider investing in vintage stock certificates:

- Historical significance: Many vintage stock certificates are incredibly beautiful works of art that offer valuable insights into the history of business and commerce from a specific era.

- Rarity: Depending on how many shares were originally issued by a company, some vintage stock certificates may be extremely rare today.

- Value appreciation potential: Like any other collectible item or antique piece, there is always the possibility that certain vintage stock certificates will increase significantly in value over time due to their rarity or historical significance.

- Diversification opportunity: Investing in vintage stock certificates allows you to diversify your portfolio beyond just traditional stocks and bonds.

What Should You Look for When Buying Vintage Stock Certificates?

If you’re interested in this type of investment opportunity, here’s what you should keep an eye out for:

- Rarity: As mentioned previously, rarity plays a huge role in determining the value of any given vintage stock certificate. The fewer shares issued by a particular company at any given time means there are fewer vintage certs available today, hence driving up demand (and price).

- Historical value: While rarity certainly adds significant value to these old pieces of paper from an investment point-of-view, it’s important also to recognize the historical value of these items. Look for certificates issued by previous giants like IBM or General Electric, which carry with them a tremendous amount of interest from history buffs and investors alike.

- Condition: Like any antique collectible, the condition of your vintage stock certificate is going to play a vital role in its overall what we know as ‘collectability’. Even minor tears or discoloration can significantly decrease the value of any given certificate.

- Documentation and authentication: Whenever you’re purchasing collectibles, particularly vintage stock certificates with significant investment potential, it’s crucial that you have all proper documentation about provenance and authentication so that there is no question as to whether or not the item is genuine.

How To Invest Responsibly

Before diving headfirst into investing in vintage stock certificates, remember that this type of investment involves some inherent risks because not all certificates will retain their value over time (no matter how rare they might be). However, with diligence and planning, along with a bit of research – old paper stocks can be valuable investments due to their rarity/historical significance while at the same time making wonderful additions to collections by enthusiasts from around the world.

Here are some tips on how you can invest responsibly:

- Do your homework: Before investing, make sure you are well-informed about what makes a particular vintage stock certificate valuable. This will help ensure that you’re not buying pieces just because they look interesting without carefully considering their inherent worth.

- Diversify: As discussed earlier in this blog, adding authentic old paper stocks as an additional facet to your collection will diversify your portfolio beyond traditional investment vehicles like mutual funds or individual stocks/bonds.

- Stay organized: Ensure every single purchase has proper documentation (e.g., letterpress notes certifying authenticity) so that if/when it comes time for selling off parts of your collection down the line, things are properly categorized and authenticated.

Conclusion

Investing in vintage stock certificates can be a fascinating way to add unique value and perspective on American history to your collection or portfolio. Whether old-time certificates strike you as beautiful works of decorative art or if you’re an investment veteran searching for alternative avenues that diversify risk, the right (properly researched) vintage paper stocks may represent the perfect choice for your portfolio goals. Remember, with all collectibles comes some degree of inherent risk, but also remember that by incorporating documentation and authentication best practices into your purchase process, things can often go relatively smoothly, ensuring protection against any doubts of authenticity down the line.