Investing in precious metals is a great way to add diversity and stability to your investment portfolio. Choose from various precious metals to diversify your holdings.

Here are ten reasons you should consider adding precious metals for a high growth investment strategy.

1. Physical Coins And Bars Get Real

If you’re investing in gold, silver, platinum, or any other precious metal, you’re actually buying the real thing – not paper claims that could be worthless in a crisis. Unlike stocks, bonds, and other paper investments, precious metals can’t be printed at will by central banks. And they have survived every financial crisis throughout history.

2. Precious Metals Are A Hedge Against Inflation

Gold, silver, and other precious metals are natural hedges against inflation. When prices rise, they tend to hold their value better than most other investments. In fact, during times of high inflation, precious metals can often be a more stable investment than paper currencies.

3. They’re Portable And Easy To Store

Precious metals are easy to store and transport. You can keep them in your home safe or in a secure storage facility. And they’re not as bulky as some other investments, like real estate.

4. They Can Offer Protection In A Crisis

Precious metals can play an essential role in your crisis portfolio. If the financial system collapses or there’s a run on the banks, precious metals will be one of the few assets that retain their value.

5. You Can Use Them For Trade

In addition to being an investment, precious metals can also be used for trade. It makes them a valuable form of currency in times of crisis or turmoil.

6. The Price Isn’t Tied To Any One Country

The price of gold, silver and different precious metals isn’t tied to any country. Their value is based on global supply and demand. It makes them a safe investment for times of instability in the worldwide economy.

7. They’re A Great Way To Diversify Your Portfolio

Precious metals are a great way to add diversity and stability to your investment portfolio. They don’t move in lockstep with other investments, so they can help reduce your risk.

8. You Can Pass Them On To Future Generations

Precious metals are tangible assets that can be passed down from generation to generation. They provide a unique form of inheritance that your family can enjoy for years to come.

9. There’s Always Demand For Them

Gold, silver, and various precious metals have been used as money for thousands of years because there is always demand for them. They’re internationally recognised and accepted as currencies all over the world.

10. They’re An Excellent Way To Invest In The Future

Precious metals are an excellent way to invest in the future. They’re a tangible asset that has stood the test of time. Their value will only increase in the future.

Investing in precious metals is a smart way to add diversity and stability to your portfolio. Talk to your financial advisor about including them in your investment strategy to get started.

How To Buy Precious Metals

If you’re ready to start buying precious metals, here are a few tips to help you get started.

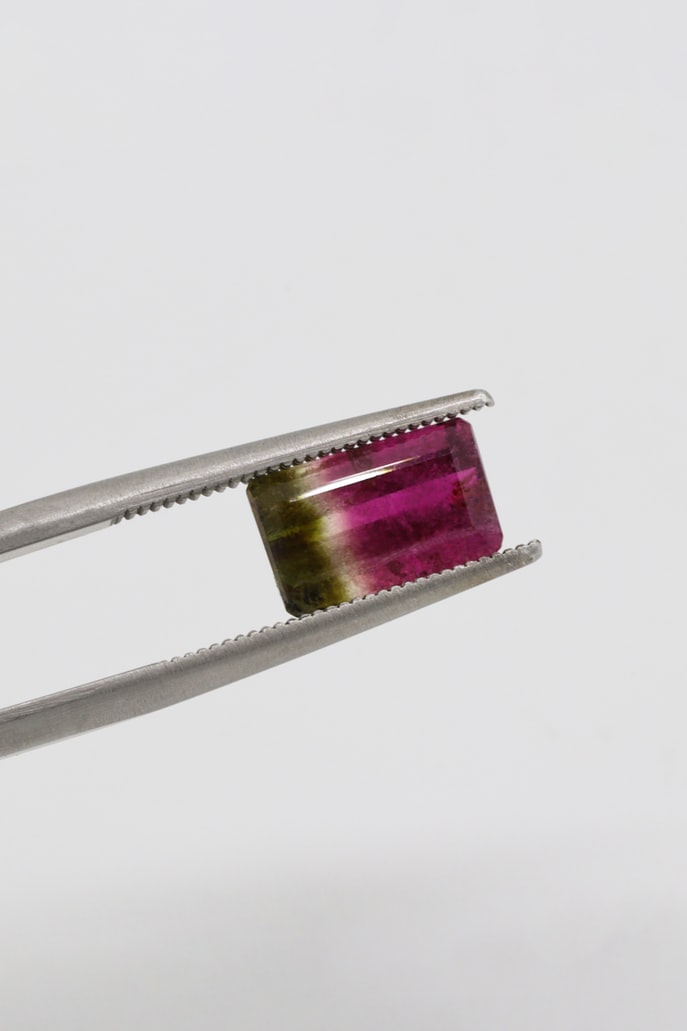

1. Decide What Type of Metal You Want

The first step is to decide what type of metal you want to invest in. Gold, silver, and platinum are the common choices, but there are also a variety of other metals that can be a valuable investment, such as rhodium and palladium.

2. Consider Buying Physical Coins or Bars

When you buy precious metals, you have two options: purchase physical coins or bars, or buy paper investments like certificates or ETFs. Most experts recommend purchasing physical coins or bars because they offer the greatest security and value.

3. Shop Around for the Best Prices

It’s essential to compare to find the best prices for your investments. When you buy coins and bars, check out local dealers and online retailers before you buy.